Dydx Trade

🪙 What is dYdX?

- dYdX is a decentralized derivatives exchange primarily focused on perpetual contracts—you can go long or short with leverage up to ~50x on its own Layer‑1 chain built with Cosmos/Tendermint trade.dydx.exchange+14kucoin.com+14tradingview.com+14.

- Trades are non-custodial (you keep your keys), on-chain, and use an order-book model—not an AMM—offering precise control over entries/exits kucoin.com.

📈 Key Stats & Updates

- 24‑hour trading volumes hover between $125M–$155M on dYdX Chain coingecko.com+1coinbase.com+1.

- Open interest sits around $220M with over 200 markets live m.youtube.com+15coingecko.com+15coinbase.com+15.

- The protocol recently launched a token buyback program, allocating 25% of net fees each month to repurchase DYDX tokens—to help reduce supply and boost value coinmarketcap.com+2coingecko.com+2coinbase.com+2.

- Instant, fee-free USDC deposits above $100 are now available across multiple chains (Ethereum, Arbitrum, Optimism, Base, Avalanche, Polygon) dydx.xyz+2coinbase.com+2dydx.xyz+2.

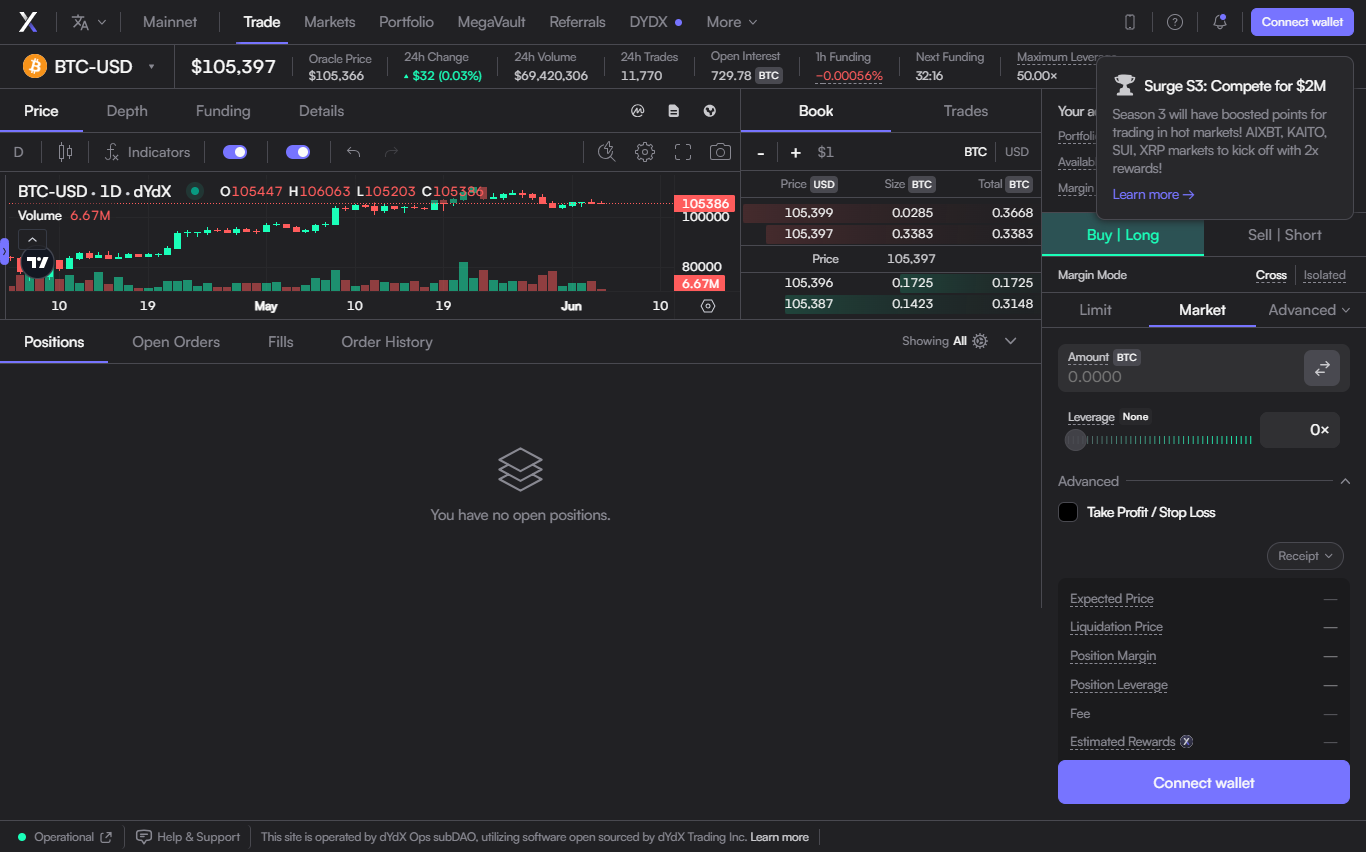

🎥 How to Trade on dYdX

Here's a walkthrough video of the trading interface and how to set up perpetual positions on the platform:

Quick steps:

- Connect a Web3 wallet like MetaMask or Coinbase Wallet.

- Deposit USDC (instant on supported chains).

- Choose a market, select long or short, set leverage (up to ~50x on mobile or 100x on web), then place a limit, market, stop, or take-profit order dydx.xyz+6blog.kryll.io+6m.youtube.com+6dydx.xyz+12dydx.xyz+12kucoin.com+12coinbase.com+1dydx.xyz+1.

- Manage positions with stop-loss/take-profit and monitor liquidation price via UI .

📱 Mobile Trading

- The Crypto.com Onchain app now integrates dYdX, offering a mobile-first experience with deposits, trading, and position management directly in-app medium.com+15dydx.xyz+15kucoin.com+15.

- dYdX’s native mobile app has both Default (beginner) and Pro modes, supporting up to 50x leverage, with clear indicators for margin usage, liquidation risk, and more .

🧠 Tips & Considerations

- Only USDC collateral is currently supported blog.kryll.io.

- There’s a tiered fee structure: makers often receive rebates, takers pay slightly more—but $DYDX rewards can substantially offset fees blog.kryll.io.

- Leverage amplifies both gains and losses—stop-loss, liquidation price, and margin management are critical tokeninsight.com+11blog.kryll.io+11dydx.xyz+11.

Ready to get started?

- Head over to dydx.trade, connect your wallet (MetaMask, Rabby, Coinbase, etc.), and deposit some USDC to begin.

- Explore official dYdX Academy and in-app tutorials to learn advanced strategies and best practices.

Let me know if you want help with setting up a wallet, using specific order types, understanding token incentives, or comparing it with other DeFi platforms!

Made in Typedream